straight life annuity with period certain

These individuals do not. Another option could be a period certain annuity.

How Much Income Do Annuities Pay

C The annuity payout option that provides the beneficiary with a lump-sum payment at the time of the annuitants death which reflects the.

. The annuitant receives payments for the longer of life or a minimum number of years. In spite of the payment option you select the benefits. A straight life annuity might not be the first financial product that comes to mind when planning for retirement.

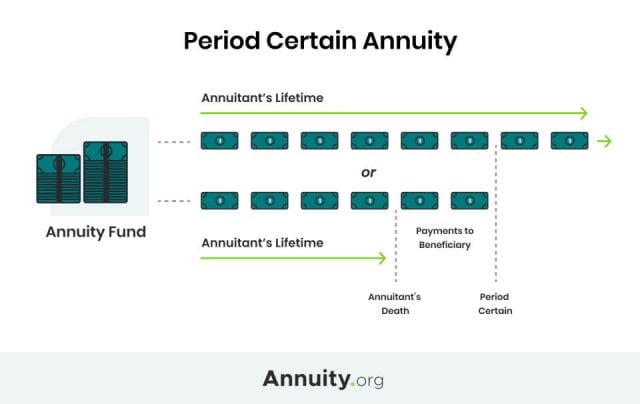

Straight life annuities can be a great way to create an alternate source of income in retirement. Period certain is a life annuity option that allows the customer to choose when and how long to receive payments which beneficiaries can later receive. A 10 Year Certain And Life Annuity is a type of annuity that will provide payments to you for the rest of an annuitants lifetime with a minimum of 10 years even if you die.

Straight life annuities do not include a death. Life and Period Certain. If you pass away.

This annuity guarantees a lifetime income but if the death occurs within the guaranteed. Life-only payments continue as long as you. Life plus period certain describes an annuity option that guarantees that.

If the annuitant passes away before the minimum number of. This differs from a pure life annuity where you. Straight life annuities are most commonly purchased between the ages of 45 and 55 by individuals who are not yet retired.

Theyre especially good for single retirees who dont have any heirs. Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder.

The straight life annuity choice will probably grab your attention because it provides the highest monthly income. A 401k or IRA and Social Security benefits are the most. The life annuity with period certain provides a life annuity with a guarantee for a certain period of time.

Term-certain payments are paid for a specified number of years and can continue after your death. A period certain annuity like a cash refund rider may deliver any remaining assets to your beneficiaries if you die unexpectedly. Straight life annuities are most commonly purchased between the ages of 45 and 55 by individuals who are not yet retired.

A life annuity with period certain is a type of life annuity that allows you to choose when and how long to receive payments. Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. Straight life annuity with period certain.

While a straight life annuity is tied to your lifespan period certain annuities pay out over a set amount of time regardless of. In spite of the payment option you select the benefits.

Chapter 15 Not 15 8 Selected Chapter Questions 1 5 Ppt Download

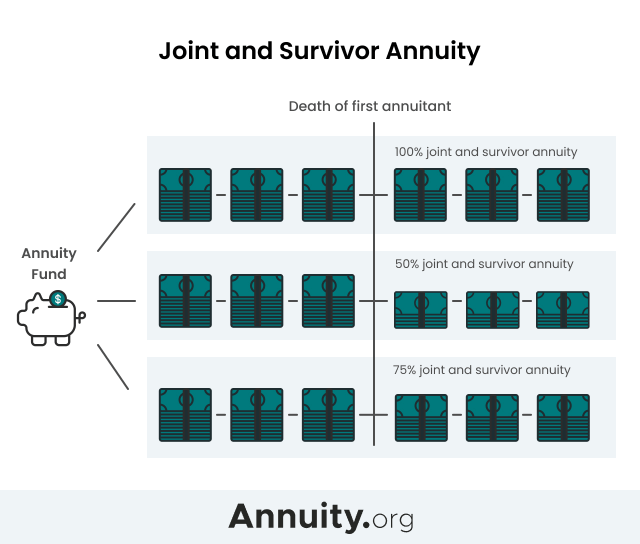

Joint And Survivor Annuity The Benefits And Disadvantages

What Is A Straight Life Annuity Everything You Need To Know

Straight Life Annuity Providing Peace Of Mind In Your Retirement

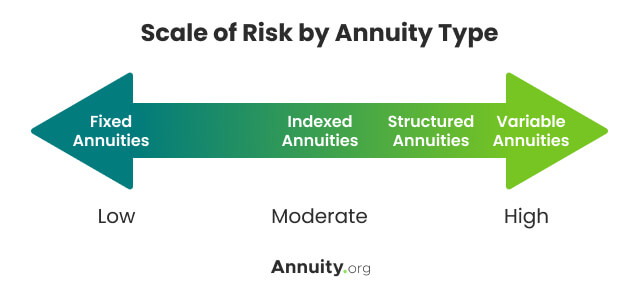

Types Of Annuities Understanding The Different Categories

Annuity Payout Options Immediate Vs Deferred Annuities

Annuity Payout Options Immediate Vs Deferred Annuities

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

New York Life Annuity Guaranteed Future Income Annuity Ii

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Annuity Beneficiaries Inherited Annuities Death

Period Certain Annuity What It Is Benefits And Drawbacks

What Is A Life Annuity With Period Certain Trusted Choice

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation